Linn County property taxes in the mail this week

ALBANY — Linn County residents will begin receiving their property tax statements this week, according to Assessor and Tax Collector Andy Stevens.

Stevens said some 62,000 statements will be mailed on Oct. 19. If you do not receive your tax statement by Nov. 1, please call the Assessment and Taxation office at 541-967-3808.

Stevens reminds people that property taxes are based on January 2023 values, so they are about one year behind current day’s value. And, he added, taxes are levied on the Assessed Value of a property.

Stevens said the Real Market Value of all property in Linn County is about $27 billion (up $2 billion) and the Assessed Value is about $13 billion (up about $600 million).

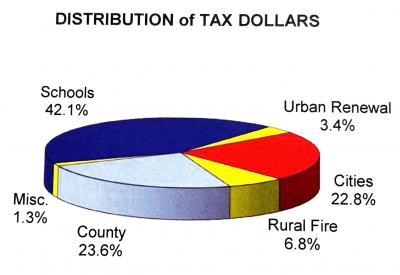

Schools receive more than 42% of Linn County taxes, the county receives 23%, cities 22%, rural fire districts almost 7%, urban renewal 3.5% and miscellaneous 1.3%.

Taxable values by city are: Albany, $4.2 billion; Brownsville, $154 million; Gates, $5.3 million; Halsey, $71 million; Harrisburg, $282 million; Idanha, $5 million; Lebanon, $1.5 billion; Lyons, $111 million; Mill City, $95 million; Millersburg, $730 million; Scio, $63.8 million; Sodaville, $20.8 million; Sweet Home, $606 million.

The total estimated tax revenue is $221,932,527. Real property, $203,027,353; personal property, $6,503,549; manufactured structures, $9,546,334.

“People may think property values should be down because they are looking at today’s slow down in the market, but these values are as of January 1, 2023,” Stevens said.

Stevens says the Assessor’s Office acts like “historians” when it comes to property values.

Pay your taxes in full by Nov. 15 and receive a 3% discount.

There are two payment drop boxes, including one at the west entrance of the Courthouse.

Information flyers will be included with tax statements and disabled veterans or spouses are reminded they can apply for exemptions.

You can look up your individual tax information at https://www.linncountyor.gov/assessor/page/account-detail.

Taxes can be paid on-line at https://www.linncountyor.gov/assessor/page/online-tax-payments.

The site also features videos that explain the property tax system at https://www.linncountyor.gov/assessor/page/property-tax-informational-videos.

Property Tax Payment Schedule

To avoid interest charges and receive any applicable discount choose one of the following payment schedules:

Full Payment: Receive a three percent (3%) discount on the current year, if paid in full by November 15. We accept postmark.

Two-thirds Payment: Receive a two percent (2%) discount on the current year, if the first two-thirds payments are made by Nov 15. Pay the final one-third balance by May 15.

One-third Payment: No discount allowed. Pay one-third by November 15. Pay a second one-third payment by February 15. Pay the final one-third balance by May 15.

Reminder notices are not sent for February or May payments.

Interest is charged on any past due installment for the schedule you choose. Statute determines the interest rate.

If you have any questions call 541-967-3808.